Revenue problems and proposed budget cuts have threatened the future of the Petal Sports Association (PSA) in recent weeks, but Petal’s primary sports organization is back in the game, at least for now, with $100,000 in funding from the Forrest County Board of Supervisors.

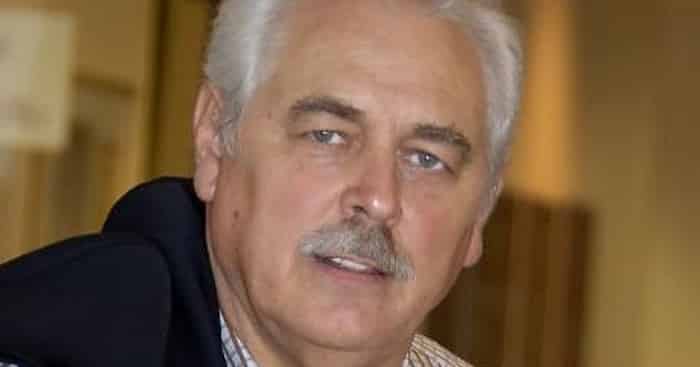

The one-time sponsorship comes from a surplus in the recreation budget of District 3 Supervisor Burkett Ross, who said he’s built the surplus during the eight years he’s held office. Reaction from citizens has been mixed. While many seem to think Ross has knocked it out of the park with this contribution, comments from others indicate that the county’s gift is a swing and a miss.

“Now that’s news!! I’m so happy to hear this,” Jen Hartfield Pulliam posted. “When one door closes another opens. They truly see the meaning of this and want to insure that every child has a [sic] opportunity to shine!”

Brushbacks on Facebook say Ross stepped up to the plate on the eve of elections and is grandstanding before voters head to the polls Tuesday. Some commenters ask why sports programs in McLaurin, Brooklyn, Rock Hill and other communities have not received funding. Others point to infrastructure and sewer issues that could have been addressed with the county’s surplus.

“That is wonderful. BUT what about all the kids on the South End of the County? The ones that we have to beg and plead for money to fix ballfields and buy equipment for?” asked Christine Moody….” On WDAM’s Facebook page. In later comments she added “We have to go and beg for the crumbs they pass out down here!!” and “I don’t begrudge any kid the financial support they need and deserve, but by God spread it around!”

Maranda Dickinson agreed. “Really? What about the ball fields and play grounds in the south end of the county? Maybe the board needs to take a ride to mclaurin and carnes [sic] and have a look.”

“Still not voting for him. He hasn’t done anything for our county,” said Michelle Walters Strebeck on WDAM’s page. “This is a political move and I’m not buying it.”

“Why did he have $100,000 surplus in his budget for eight years is my question?” Carol Vogel McGee posted on Hattiesburg Patriot. “Why didn’t he help Petal before with this money as our Supervisor? Held it all till a few days prior to election after eight years of holding it? Forrest County Politics as usual.”

Debbie Hunt did not accept that line of thinking and instead praised Re-Elect Burkett Ross for County Supervisor in her comment on the HP site. “If you did [sic] for political motives, then kudos to you! Well played! But knowing the heart you have for children, I know you did it for them.”

Money from the county will be used for uniforms, helmets and other sports supplies children need, according to a Facebook post by Petal Mayor Hal Marx. He noted that Ross stipulated that he would have a problem with using the funds for cutting grass.

“The problem we face is with maintenance of the fields. This donation does nothing to help with that,” Marx said. He added that because this appears to be a one-time donation, “…the long-term issue also remains. This is a great last-minute political stunt to get some votes…but it truly does nothing to guarantee that the present arrangement between PSA and the city continues.”

Marx has posted previously on Facebook to explain the financial losses the City of Petal has incurred since it joined forces with PSA, a nonprofit, in late 2017. You can read the original agreement for the PSA-Petal joint venture here.

PSA has increased its offerings and registrations but the revenue it generates does not cover the bases, Marx said. He reported that PSA returned just over $100,000 from its revenues each year to the city, but said Petal has spent almost $800,000 annually, mostly to maintain sports complexes and pay Athletic Department staff members.

“After two years, the aldermen and I have reached the conclusion that this situation isn’t sustainable…. No business can continue to spend $700,000 per year more than it brings in,” he said. According to Marx, PSA rebuffed the City of Petal’s attempts to discuss a solution that would cost less in taxpayer funds and depend more on volunteer efforts, and instead took the debate public.

In a PSA budget meeting last Monday, association president Derek Hall outlined several cost-cutting measures that are in the works. He said PSA has consolidated some programs and will lease fields and grow its sponsorship program to increase its revenue. Also, Hall said, PSA will stop providing free football equipment to players and will increase registration fees to align them with fees charged elsewhere. Discussions between PSA and the City of Petal continue.