Contrary to a front-page story in a major Mississippi newspaper, the phase-down of Mississippi income taxes will not begin until January of next year. The new law setting that phase-down in motion technically took effect July 1, the usual date each year for new laws to actually become law. But changes in tax laws usually apply to calendar years, since most taxpayers operate on a calendar (not fiscal) year basis, and this law is no exception.

While it’s on people’s minds, though, we thought we’d remind everyone what the bill calls for and what effect it will have on various taxpayers.

The first point to note is that these reductions only apply to personal income taxes. There were no cuts to corporate income taxes. However, the income of most small business owners, even if their business is technically a “corporation,” is taxed at the personal rate (for reasons we won’t go into here), so the vast majority of Mississippians will benefit, including business owners.

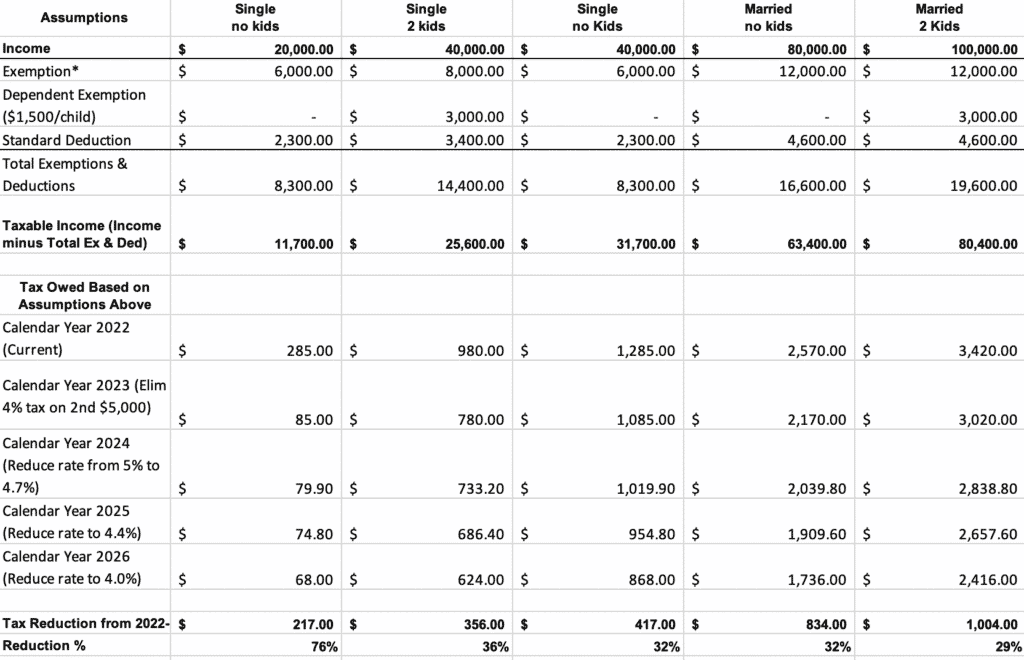

For calendar year 2023, any taxpayer who has more than $10,000 in taxable income (total income minus exemptions and deductions) will receive a $200 tax reduction. That’s because the first year’s cut is the elimination of the 4% bracket, which is currently applied to a $5,000 block of income (4% x $5,000 = $200).

Because the 3% rate on the first $5,000 of taxable income had already been eliminated by previous law, Mississippi will no longer tax the first $10,000 in taxable income, beginning in 2023. That will leave the state with a flat rate of 5% on income over $10,000.

In 2024, the 5% rate will be reduced to 4.7%. In 2025, it will be reduced to 4.4%. And in 2026, it will be reduced to 4%.

This table shows the effects for each year for various taxpayers.

*A single person with children, if designated as “Head of Family,” technically has a $9,500 exemption, but that includes 1 child at $1,500 exemption. Since we are showing a single person with 2 children, we included the exemption for the first child in the total for Dependent Exemptions to limit confusion when comparing to the married couple with 2 children.